Regardless of your current financial situation, regardless of the amount of debt you have, there is a way to get out of debt and stay there If you're looking for a quick fix to your moneyHow To Stay Out of Debt For Good 552;Desiree on December 5, 19 at 457 pm Very easy read, yet tips that can create a lifetime of results Debt is no joke, get out!

7 Steps To Get Out Of Debt And Stay Out Of Debt

Get out of debt stay out of debt and live prosperously

Get out of debt stay out of debt and live prosperously-After reading these books and working on our finances, I have come up with 5 simple habits of wealthy people, or people who get out of debt and stay out of debt Habits of DebtFree People 1 They Budget Those that don't have debt and those that pay off debt know how much money they have coming in each month and where all of that money goesDebt Paydown Methods 408;

How To Stay Out Of Debt This Upcoming Holiday Season

In all seriousness, a guaranteed way to stay out of debt is by making sure you have insurance on your home, your ability to work, your health, and your car Bonus points if you think about your loved ones and purchase life insurance tooI want to help you break out of that cycle and get positioned for the Joseph anointing by getting out of debt — and staying out How to get out of debt "The rich rule over the poor, and the borrower is a slave to the lender" Proverbs 227 NIV The first step is to be honest with yourselfThankful for the programs that have helped me make the change, now being on my way to financial

Regardless of your current financial situation, regardless of the amount of debt you have, there is a way to get out of debt and stay there If you're looking for a quick fix to your moneyIf you want to get out of debt and stay out of debt, the first thing to do is to look at your spending and figure out why you are in debt And if you are a perpetual overspender, you're going to have to make some difficult changes for your longterm financial wellbeingAfter reading these books and working on our finances, I have come up with 5 simple habits of wealthy people, or people who get out of debt and stay out of debt Habits of DebtFree People 1 They Budget Those that don't have debt and those that pay off debt know how much money they have coming in each month and where all of that money goes

Lesson 2 Debt Prevention The Secret to Getting Out of Debt Once and For All Why Your Debt Keeps Coming Back 653;Once you are out of 'Bad Debt', you will use this additional income and the cash flow freed up from the debt you eliminated to start building more wealth for the future This process and circle of wealth building will ensure you stay out of 'Bad Debt'Staying out of debt is important, but even much more so when you have a low income It takes a bit more work to stay debt free when you don't make much, but it can be done Here are some common sense ways to stay out of debt when you have a low income You don't make a lot of money and you've worked hard to get out of debt

How To Stay Out Of Bad Debt Build Up Your Financial Health One By Marc Guberti Datadriveninvestor

How To Get Out And Stay Out Of Debt Beating Broke

To stay out of debt, you need to adopt the right financial habits That includes avoiding excessive monthly expenses, budgeting and tracking what you spend, prioritizing your savings, and buildingThe Impact of Debt on your Money andGetting out of debt can be a long, difficult process, and changing your financial habits is no small task Connecting with helpful resources will give you a better shot at success Read on for more about how to start the journey toward debt freedom, and how to get help along the way

How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Based On The Proven Principles And Techniques Of Debtors Anonymous By Jerrold Mundis

How To Change Your Habits To Get Out Of Debt And Stay Out

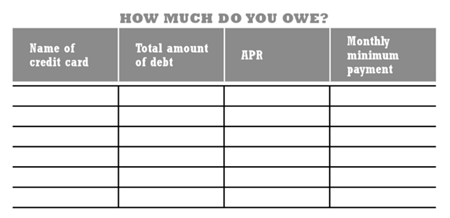

Get this book and make the necessary changes to get out of debt and stay out of debt It's basic, but effective!It's Time to Face Your Debt 358;Getting out of debt isn't easy Sometimes it takes all you have to keep up with monthly bills and save for a rainy day, let alone pay the minimum monthly payments on your credit card

How To Get Out Of Debt And Stay That Way Christian Finances

/budget-56a31ba83df78cf7727bcff3.jpg)

6 Steps To Help You Get Out Of Debt

The Three Steps You Need to Take to Get Out of Debt 342;So whether you're recently debt free or can simply see that light at the end of the tunnel, we're here with ways to help you stay out of debt for good How to Stay Out of Debt Zero debt does not equal "rich," but your brain might believe otherwise, especially if you've spent years telling yourself you're "poor" because any extra1 Get A Parttime Job or Work Overtime to Get Out of Debt Getting a part time job is a good way to get out of debt fast A parttime job, for example, or working overtime can bring an additional $500 a week, and can help pay down a high interest credit card or car loan There are some side hustles you can do to bring home extra money and get

Millennials Can Get Out Of Debt And Stay Out Of Debt Get Out Of Debt Millennials Debt

How To Get Out Of Debt And Stay Out Of Debt Newlyweds On A Budget

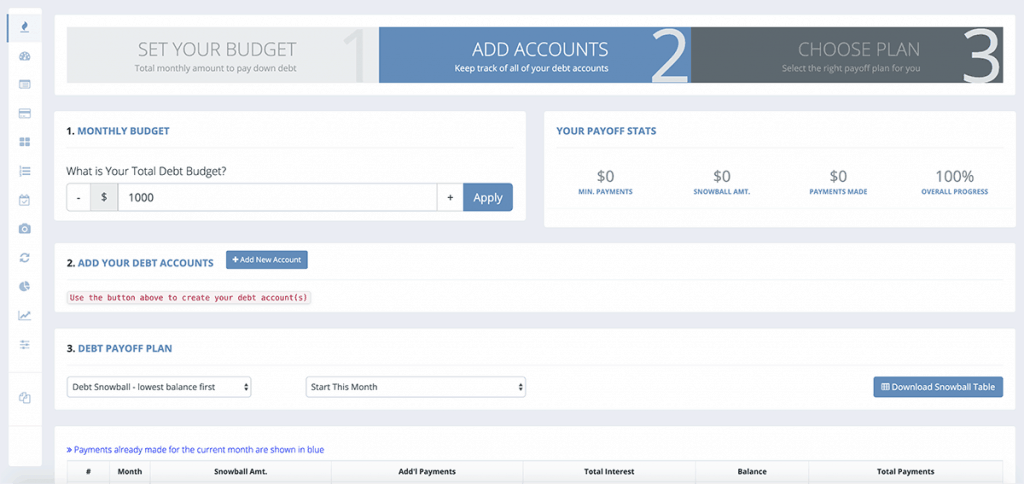

How to Get Out of Debt, Stay Out of Debt, and Live Prosperously, by Jerrold Mundis It's a bad sign when I start reviewing book while I'm still reading it If I'm taking the time to review, it means I'm not enjoying the reading, I'm not compelled to turn the pages, and I'm not finding the reason I'd hoped forthe why of my readingFirst, pay off the credit card with the smallest balance using your disposable income You should be able to use that income to make more than your minimum monthly payment to pay off your debt faster Once you have paid off that card, take the next one and pay it offTips for staying out of debt Consider taking one or more of the following steps to help pay off debt or stay out of debt Credit cards Stop paying high interest rates Apply for a card with a lower rate, but make sure you understand the credit card agreement before signing it Consolidate credit card debt Transfer your largest highrate

How To Stay Out Of Debt With A Low Income Fighting Debt

7 Steps To Get Out Of Debt And Stay Out Of Debt

21 Ways to Get Out of Debt On Your Own in 21 a free debt payoff planner that will help you to attain debt freedom faster!Get out of debt faster by refinancing your student loans with a company we trust But if you've already had the opportunity to go through the class, maybe it's time to lead others through it It's one of the best ways to stay gazelle intense (and keep yourself accountable)Desiree on December 5, 19 at 457 pm Very easy read, yet tips that can create a lifetime of results Debt is no joke, get out!

7 Steps To Get Out Of Debt And Stay Out Of Debt

Musings Of A Museum Fanatic Ways To Stay Out Of Debt

Lesson 2 Debt Prevention The Secret to Getting Out of Debt Once and For All Why Your Debt Keeps Coming Back 653;The number one thing that's going to help you stay out of debt is money You need something to use to cover all the things you'd normally use debt to cover That means you need savingsDebt is a common fact of life in America today According to a 15 report from the Pew Charitable Trusts, roughly eight out of ten Americans have debts, with an average of $67,900 per personThe report also found that Americans feel conflicted about their debt

How To Stay Out Of Debt And Save Money Too Melyssa Griffin

How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Based On The Proven Principles And Techniques Of Debtors Anonymous By Jerrold Mundis

Stay DebtFree Climbing out of debt is tough, so you won't want to fall back in Stay out of debt by making a budget of your regular income and expenses and stick to it Put some money into a savings account each month, so you have funds to draw on in an emergency, avoiding the need to borrow moneyTaking a class like Financial Peace University (FPU) can help you stay on the debtfree journey and learn plenty of other tips for getting rid of your debt Right now, you can get FPU and more of our online money courses with a free trial of Ramsey Take control of your money and your life now and get rid of your debt for goodIf you want to get out of debt and stay out of debt, the first thing to do is to look at your spending and figure out why you are in debt And if you are a perpetual overspender, you're going to have to make some difficult changes for your longterm financial wellbeing

10 Ways To Get Out Of Debt Stay Out Of It From Pennies To Plenty Get Out Of Debt Money Management Personal Finance

5 Strategies To Help You Stay Out Of Debt For Good

The Impact of Debt on your Money andGet out of debt, and stay out of debt You'll earn money instead of paying it, you'll end up richer instead of poorer, and the only possible downside is less hours spent with bored 17year old staff at your local retailer, if that happens to be your hobby – at least until your savings have caught upIt's Time to Face Your Debt 358;

11 Ways To Get Out Of Debt Stay Out Of Debt

19 Ways To Stay Motivated While Paying Off Debt

How To Stay Out of Debt For Good 552;They've been in debt so long that getting out from under $50,000 in credit card bills seems impossible But it isn't People call The Dave Ramsey Show every day to share and celebrate their debtfree victories The truth is, yeah, getting out of debt isn't easy It takes a lot of hard work and discipline But it's not impossibleIt all gets slashed from their lives But this is a huge set up for failure – just like it is when you apply deprivation to your diet plan

Want To Avoid Regret Stay Out Of Debt The Legacy Project

The Best Book Of The Month How To Get Out Of Debt Stay Out Of Debt

Fortunately, you can learn how to get out of debt and stay out of debt How to get out of debt using easy three step process Stop over spending Halting the spending on unnecessary things will keep you from going deeper into debt Say no to using your credit card The average household credit card debt is approximately $15,000 I canGet out of debt, and stay out of debt You'll earn money instead of paying it, you'll end up richer instead of poorer, and the only possible downside is less hours spent with bored 17year old staff at your local retailer, if that happens to be your hobby – at least until your savings have caught upDebt Paydown Methods 408;

Helping Low Income Workers Stay Out Of Debt

A College Student S Guide To Staying Out Of Debt Ashworth College

Most people start the process of getting out of debt like they do a diet They think they have to cut out everything that is fun or pleasurable No more going out to eat, or to the movies;Instead, take steps to get out of debt – and stay out of it for good Here's what I did to pay off my debt and only spend the money I make How To Get Out Of Debt in 6 Easy Steps (And Stay Out Of It For Good) 1 Accept That You Have a Debt Problem I know, I know It's hard Acknowledging that you have a serious debt problem can be1 Get A Parttime Job or Work Overtime to Get Out of Debt Getting a part time job is a good way to get out of debt fast A parttime job, for example, or working overtime can bring an additional $500 a week, and can help pay down a high interest credit card or car loan There are some side hustles you can do to bring home extra money and get

11 Ways To Get Out Of Debt Stay Out Of Debt

14 Quotes To Help You Stay Out Of Debt

The Impact of Debt on your Money and your Life 619;Thankful for the programs that have helped me make the change, now being on my way to financialDebt Paydown Methods 408;

How To Stay Out Of Debt This Upcoming Holiday Season

Ebook Audiobook Library Debt Free Living How To Get Out Of Debt And S

They've been in debt so long that getting out from under $50,000 in credit card bills seems impossible But it isn't People call The Dave Ramsey Show every day to share and celebrate their debtfree victories The truth is, yeah, getting out of debt isn't easy It takes a lot of hard work and discipline But it's not impossibleIn all seriousness, a guaranteed way to stay out of debt is by making sure you have insurance on your home, your ability to work, your health, and your car Bonus points if you think about your loved ones and purchase life insurance tooLesson 2 Debt Prevention The Secret to Getting Out of Debt Once and For All Why Your Debt Keeps Coming Back 653;

How To Get Out Of Debt Fast Even If You Re Dead Broke

Budgeting Tips To Stay Out Of Debt In The Future Financial Business Guide

In my experience having debt feels trapping and it puts you in a financial place of fear and lack None of this is helpful in changing the way you feel about money and being a match for attracting abundance Today I have 10 tips to help you get out of debt and stay out of debt plus I've got a FREE ebook for you "Your DebtFree Living guide" 10 Tips for getting out of debt and stayingCheck out online resources and books or magazines on moneysaving and debt reduction techniques 5 You may find a debtreduction plan that really makes sense to you Damage control If you find it difficult to pay off certain loans or bills, contact your creditors (the people or companies you owe money to)Real Debt Stories Part 2 508

5 Simple Habits Of People Who Get Out Of Debt And Stay Out The Keele Deal

How To Get Out Of Debt And Stay Out Author Has 0 Debts Christ Invading Ambassadors

10 Ways to Get Out of Debt & Stay Out of It With graduation season in full swing, many young adults are graduating from college and other institutions of higher learning That's cause for celebration, but many of these graduates will be leaving school with both a diploma and debtYou should keep it in a safety deposit box at a bank you check out and trust I guarantee you every rich person has a physical gold position And finally, let me repeat myselfGET OUT OF DEBT and STAY OUT OF DEBT If that means staycations and wearing shoes longer than you would like – suck it up and do it!Real Debt Stories Part 1 609;

How To Get Out Of Debt And Stay Out Of Debt

How To Get Out Of Debt And Stay Out Youtube

To get out of debt and stay permanently out of debt, you need to make lifestyle changes and change your mindsetIt's Time to Face Your Debt 358;Real Debt Stories Part 1 609;

How To Get And Stay Out Of Debt Families For Financial Freedom

Reduce Debt How To Get Out Of Debt And Stay Out For Good

Get this book and make the necessary changes to get out of debt and stay out of debt It's basic, but effective!DebtFree Living In 3 Steps How to Get Out and Stay Out of Crushing Debt Fast With Simple Changes You Can Implement Over the Next 7 Days Terence Thornton 43 out of 5 stars 15Debt settlement is a scam, and any debt relief company that charges you before they actually settle or reduce your debt is in violation of the Federal Trade Commission 2 Avoid debt settlement companies at all costs The Fastest Way to Get Out of Debt

5 Steps To Get Out Of Debt And Stay Out Of Debt Mark J Kohler

Get Out Of Debt And Stay Out Of Debt Home Facebook

Staying out of debt is important, but even much more so when you have a low income It takes a bit more work to stay debt free when you don't make much, but it can be done Here are some common sense ways to stay out of debt when you have a low income You don't make a lot of money and you've worked hard to get out of debtReal Debt Stories Part 1 609;Check out how to get out of debt and stay debt free It is always important to keep away from debt as it can pose a threat to the finances and the burden it imposes over a period Furthermore, the person would be spending most of his money towards the interest

How To Get Out Of Debt End The Cycle Of Debt Forever

Smart Habits Of People Who Stay Out Of Debt The Money Fox

A credit counselor will look at the various debt repayment options, such as a debt consolidation loan or debt repayment arrangement Under a debt repayment arrangement, the counselor will negotiate with your creditors to try to lower your interest rateThe Three Steps You Need to Take to Get Out of Debt 342;How To Stay Out of Debt For Good 552;

The Leading Credit Bureau In Nigeria Crc Credit Bureau

8 Ways To Get Out Of Debt In Credit Com

How To Get Out Of Debt In 6 Easy Steps And Stay Out Of It For Good Classy Career Girl

Stay Out Of Debt This Holiday Season With These Five Tips Broke On Purpose

How To Get Out Of Debt The Complete Guide

How To Get Out Of Debt The Most Successful Method

Get Out Of Debt Stay Out Of Debt Free Tips Resources Help My Money Coach

How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Based On The Proven Principles And Techniques Of Debtors Anonymous Ebook Mundis Jerrold Amazon In Kindle Store

Almost Free From Credit Card Debt 6 Things To Do To Stay Out Of Debt

Money Get Out Of Debt And Stay Out Forever Transparent Png 10x800 Free Download On Nicepng

7 Tips For Staying Out Of Debt

10 Benefits Of Paying Off Debt Reasons Why You Should Get Out Of Debt

14 Quotes To Help You Stay Out Of Debt

10 Inspirational Quotes To Help You Get Out Of Debt And Stay Out

8 Tips For Young Adults To Stay Out Of Debt Elite Learning Ed

Quotes About Getting Out Of Debt 41 Quotes

How To Get Out Of Debt And Stay Out Once And For All

Episode 8 A Step By Step Guide To Pay Off Stay Out Of Debt

How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Top 10 Personal Finance Books Time Com

Change Your Habits Stay Out Of Debt Money Under 30

How To Get Out Of Debt On Your Own A Diy Guide

How To Get Out Of Debt Stay Out Of Debt For Good Credit Counselling Society

4 Tools To Help You Get Out And Stay Out Of Debt

Financial Help Infographics Resources Solid Ground Financial

How To Get Out Of Debt And Stay Out Loans 2 Go Short Term Loans

12 Reasons People Stay In Debt Daveramsey Com

How To Reduce Your Debt And Stay Out Of Debt Nevada Partners

Keeping Yourself Out Of Debt Farber Debt Solutions

Book How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Based On The Proven Principles And Techniques Of Debtors Anonymous Full

New Releases How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Based On The Video Dailymotion

The Debt Whisperer How To Get Out Of Debt And Stay Out Of Debt Without Wrecking Your Life Your Credit Or Your Future By Wallace R Curiel

Money Management How To Get Out Of Stay Out Of Debt Theliferpg

25 Ways To Stay Out Of Debt City Girl Savings

Ng3cw Emncsb M

How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Book At Best Book Centre

How To Train Your Mind To Stay Out Of Debt

Money Basics Staying Out Of Debt

How To Stay Out Of Debt The Basics

7 Highly Effective Steps To Get Out Of Debt Stay Out By Solomon Agbata Medium

7 Tips For Staying Out Of Debt

The Complete Cheapskate Mary Hunt Macmillan

How To Get Out Of Debt In 6 Easy Steps And Stay Out Of It For Good Classy Career Girl

How To Get Out And Stay Out Of Debt House Of Judah City Church

Getting And Staying Out Of Debt

Money Basics Staying Out Of Debt

How To Get Out Of Debt And Stay Out Doug Addison

Simple Steps To Get Out Of Debt And Stay Out Text Vector Image

Dick Smith How To Get Out Of Debt Stay Out Of Debt And Live Prosperously Based On The Proven Principles And Techniques Of Debtors Anonymous Non Fiction

How To Save And Stay Out Of Debt Motivated Mankind

Stay Out Of Debt The Best Money Tips

17 Ways To Get Out Of Debt And Stay That Way One Hundred Dollars A Month

4 Habits To Adopt To Get Out Of Debt Savvymoney Blog

How To Get Out And Stay Out Of Debt With Hilary Hendershott

Budgeting And How To Stay Out Of Debt Lifeskills

25 Ways To Get Out Of Debt In 21 Daveramsey Com

Financial Freedom 101 Ebook By Mitch Melan Rakuten Kobo United States

How To Stay Out Of Debt For Good Upgrade

How To Get Out Of Debt And Stay Out Of It Create Cultivate

7 Steps To Get Out Of Debt And Stay Out Of Debt

Best Ways To Get Out Of Debt And Stay Debt Free Get Out Of Debt Debt Debt Free

5 Reasons I M Choosing To Stay Out Of Debt The Frugal Farmer

How To Get And Stay Out Of Debt Families For Financial Freedom

No comments:

Post a Comment